How to find tops and bottoms in Forex? Is catching tops and bottoms really risky? Finding the top and bottom is not as difficult as you think, it simply takes patience. Why do I make such an opinion? Let's dissect the problem with this article.

- Finding the tops and bottoms means you are a countertrend trader, and you are expecting to find the ideal entry point, as soon as the price reverses.

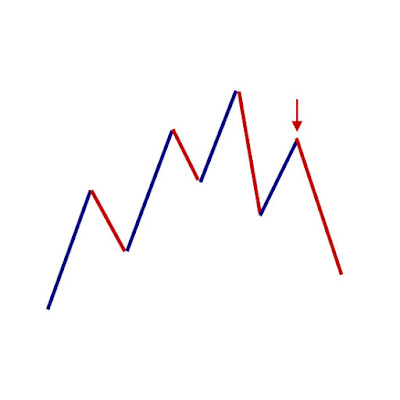

- For the trend to actually reverse, usually the price will return close to the point where you thought it was the top or bottom, to test at least 1 more time before establishing the top or bottom. So, what you need to do is wait patiently for the price test signal before entering the order. These test signals can be identified by technical patterns such as: 2 bottom / 3 bottoms, 2 tops / 3 tops, head and shoulders pattern or inverted head and shoulders...

- For example, if you see the price is going up and you want to find the top (find the sell point), the price is increasing, you should wait patiently, when it is "tired" then observe more closely. If it is tired, it will have to decrease, then it will increase again to retest the top, then it is not too late to enter the order. Of course, in some cases, the entry price will not be as good as the "real top" price (if the price returns to test but fails to rise to the top), but slows down by 1 beat and has a basis, again much safer.

- Multi-timeframe analysis: Multi-timeframe analysis will give you an overview of the price movement area, as well as the price movement during the analysis period. Note the selection of the appropriate time frame. And especially note that the large time frame will have a dominant effect on the trend of the small time frame.

- For example, the Eur/Usd currency pair below on the 1-week timeframe is in favor of a downtrend, in favor of a sell order.

- And on the 4-hour time frame, finding the top to enter a sell order is not too risky, if you patiently wait for the price to create a double top pattern (or its variation), or head and shoulders pattern, and enter a sell order like the arrow in the image.

- Need a specific plan: Finding the top and bottom in forex trading requires a specific plan for possible situations. In other words, it needs to be codified, and combined with other important factors in technical analysis. This will gradually increase efficiency over time.

- Need to be patient to keep the profit order to the right exit point: The stop-loss exit is where we determine that the initial judgment is wrong, and the profit-taking point is where the game has completely reversed. Usually holding a loss until it hits a stop loss is not as difficult as holding a profit until the price hits take profit. But, anything is possible, and it takes practice, and over time it will be achieved, for sure.

- Need to consider volume signals: As shared, every trading system must pay attention to volume signals, because it is like a torch that shows you more clearly what you are doing and where you will go. Volume patterns are a good reference.

- Practice non-stop: “All theory is gray, my friend. But forever green is the tree of life”. Through real battles and non-stop practice, you can master whether it is a simple or complex skill... The skill of finding peaks and troughs in forex is no exception.

If you find the article good, please share it, thank you.

Best regards,

No comments:

Post a Comment