- GBPUSD is cementing a cushion below 1.1900 ahead of US Durable Goods data.

- An improvement in US Durable Goods Orders could create more troubles for the Fed ahead.

- UK Hunt is looking for more ways to strengthen its trade relations with the EU.

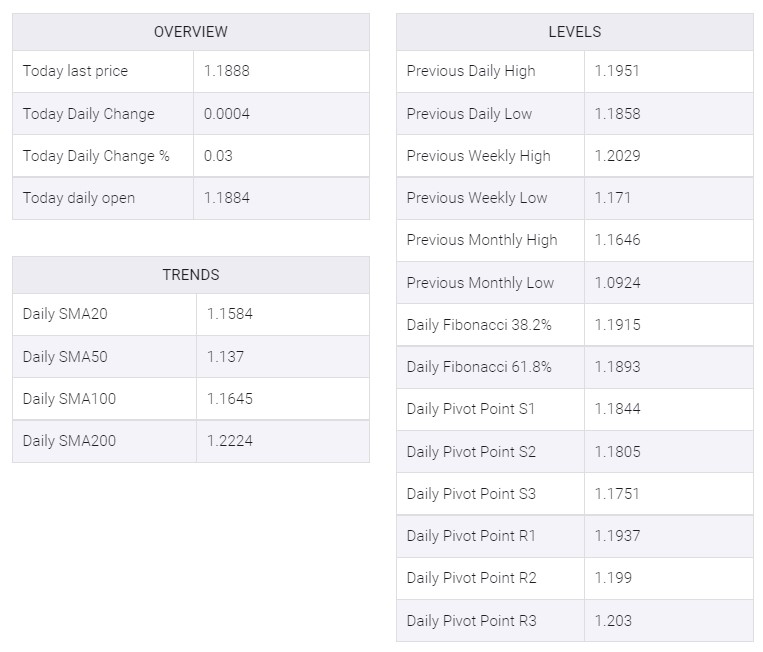

The GBPUSD pair is building a base marginally below the round-level resistance of 1.1900 in the early Asian session. The Cable is continuously getting cushion around 1.1880 as overall optimism in the market is support bulls while the upside is capped amid uncertainty over the release of the US Durable Goods Orders data.

The market sentiment remained upbeat on Monday despite tensions between North Korea and the US. Going forward, the risk profile is expected to remain solid amid an absence of critical triggers for decisive action. The US dollar index (DXY) is facing pressure around 107.00 after a sheer rebound on Friday from 106.40. Meanwhile, the 10-year US Treasury yields have rebounded to nearly 3.83% after Federal Reserve (Fed) hiked the target for neutral rates.

Fed policymaker has considered a range of 4.75% - 5.25% as reasonable for the policy rate end-point. She further added that the central bank wants to see a slowdown in the economy to cool down the red-hot inflation.

This week, major action will come after the release of the US Durable Goods Orders data, which will release on Wednesday. As per the estimates, the economic catalyst will remain steady at 0.4% Consistency in demand for durable goods in times when the Fed is struggling to drag the core Consumer Price Index (CPI) could create more vulnerability.

Fed chair Jerome Powell is focusing to cool down red-hot inflation by downsizing overall demand for households as it won’t leave any hope for manufacturers to keep prices stable or higher. Also, sustainability in demand for durable goods indicates that households are banking more on higher interest rate obligations to fulfill the demand of their durable goods.

On the UK front, UK Finance Minister Jeremy Hunt said on Friday, “I am confident we will be able to remove the vast majority of trade barriers with the European Union (EU) outside the single market.” He further added that “We can find other ways to more than compensate for the advantages of being in the single market,”

Last week, a rebound in monthly UK Retail Sales data failed to pour significant enthusiasm in the Pound Sterling. The monthly Retail Sales landed at 0.6%, against expectations of a flat performance. While the annual data improved to -6.1%.

GBP/USD

No comments:

Post a Comment