AUD/USD stages a modest recovery from the YTD trough, albeit lacks follow-through.

A slightly better Australian GDP lends support to the pair amid subdued USD demand.

China’s economic woes cap any meaningful gains ahead of the US ISM Services PMI.

The AUD/USD pair finds some support in the vicinity of mid-0.6300s for the second straight day and stages a modest recovery from a fresh low since November 2022 touched this Wednesday. Spot prices, however, struggle to capitalize on the move and remain below the 0.6400 round-figure mark through the early European session.

The US Dollar (USD) takes a brief pause and digests the recent rise to a six-month peak, which, along with the better-than-expected release of the Australian GDP report, prompts some intraday short-covering around the AUD/USD pair. In fact, the Australian Bureau of Statistics reported that the economy expanded by 0.4% during the April-June period, a touch higher than the 0.3% rise anticipated and the 0.2% growth registered in the previous quarter. The yearly rate also surpassed market expectations and came in at 2.1% as compared to the 2.3% seen in the first quarter.

The AUD/USD pair, however, lacks bullish conviction amid concerns about the worsening economic conditions in China. Apart from this, persistent US-China trade tensions keep a lid on the China-proxy Australian Dollar (AUD). In the latest development, US Secretary of Commerce Gina Raimondo said that she doesn't expect any changes to the US tariffs imposed on China by the Trump administration until the completion of the ongoing review by the US Treasury. This comes on top of expectations that the Reserve Bank of Australia (RBA) is done raising interest rates.

It is worth recalling that the Australian central bank decided to stick to its wait-and-see stance and left the Official Cash Rate (OCR) unchanged at 4.10% for the third straight month on Tuesday. Furthermore, the accompanying monetary policy statement offered little hawkish surprise and fueled speculations that the RBA policy tightening cycle is over. In contrast, the markets are still pricing in the possibility of one more 25 bps rate hike by the Federal Reserve (Fed) in 2023. The outlook remains supportive of elevated US Treasury bond yields and favours the USD bulls.

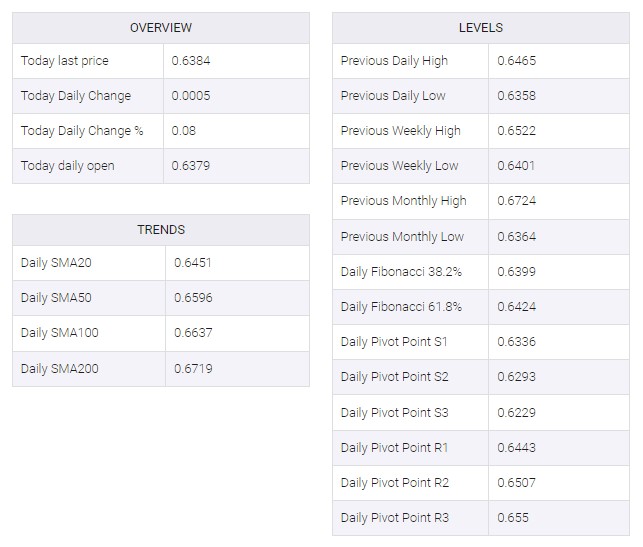

The aforementioned fundamental backdrop, along with the overnight breakdown through the bearish flag pattern, suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, any attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Traders now look to the release of the US ISM Services PMI, due later during the early North American session. Apart from this, the US bond yields will influence the USD and contribute to producing short-term trading opportunities around the major.

Technical levels to watch

AUD/USD

No comments:

Post a Comment