- EUR/USD currency pair struggles to gain any meaningful traction and oscillates in a narrow trading band.

- Rebounding US bond yields, recession fears revive the USD demand and act as a headwind.

- The uncertainty about the Fed’s rate-hike path caps the greenback and offers some support.

The EUR/USD pair struggles to capitalize on the overnight bounce from the 1.0440 area, or the lower end of its weekly range and oscillates in a narrow trading band on Thursday. The pair is currently placed around the 1.0500 psychological mark, nearly unchanged for the day.

Following the previous day's pullback, the US Dollar regains some positive traction and turns out to be a key factor acting as a headwind for the EUR/USD pair. The recent positive US economic data fueled speculations that the Fed might lift rates more than recently projected. This, in turn, pushes the US Treasury bond yields, which, along with growing recession fears, revive demand for the safe-haven buck.

The shared currency, on the other hand, is undermined by diminishing odds for more aggressive rate hikes by the European Central Bank (ECB). Apart from this, worries about economic headwinds stemming from the protracted Russia-Ukraine conflict further contribute to capping the upside for the EUR/USD pair. The downside, however, remains cushioned amid rising bets for a 50 bps Fed rate hike in December.

Firming expectations that the US central bank will slow the pace of its policy tightening is holding back the USD bulls from placing fresh bets and lending some support to the EUR/USD pair. Hence, the focus remains glued to the highly-anticipated FOMC policy meeting on December 13-14. The ECB is also scheduled to announce its decision on Thursday, which should provide a fresh directional impetus to the major.

In the meantime, traders on Thursday will take cues from the release of the Weekly Initial Jobless Claims data from the US, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, might influence the USD price dynamics and allow traders to grab short-term opportunities around the EUR/USD pair.

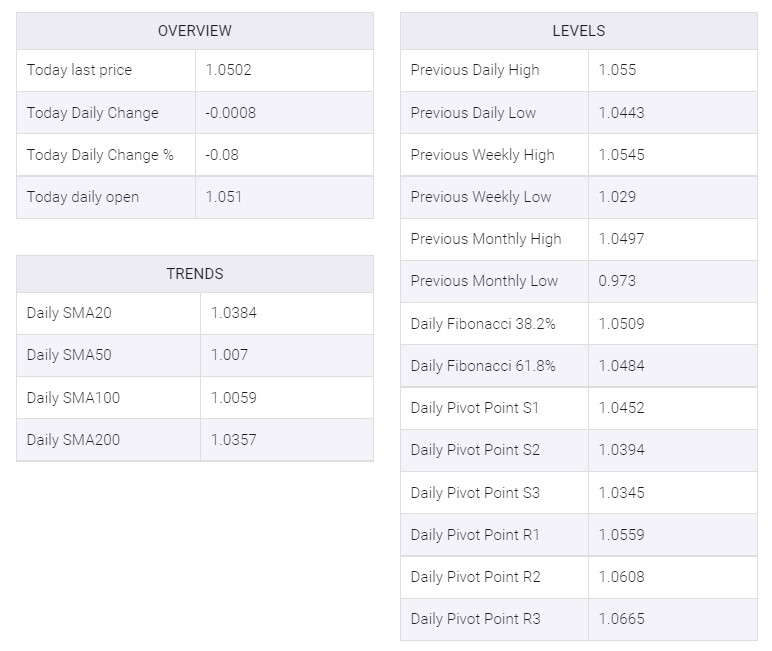

Technical levels to watch

EUR/USD

No comments:

Post a Comment