- AUD/NZD stays defensive at the lowest levels since late January 2022.

- Fresh challenges to sentiment, RBA versus RBNZ divergence challenge the buyers.

- RBA braces for 0.25% rate hike but the future guidance will be crucial for clear directions.

AUD/NZD drops to a fresh low since late January as bears poke 1.0590 mark while waiting for the Reserve Bank of Australia’s (RBA) Interest Rate Decisions during early Tuesday. In doing so, the cross-currency pair reverses the previous day’s corrective bounce amid a broad-based pullback in the Australia Dollar (AUD) amid mixed sentiment.

Fresh fears emanating from Russia join the market’s doubts over the US Federal Reserve’s (Fed) next moves seemed to have recently weighed on the AUD/NZD bears. Also favoring the pair sellers could be the dovish expectations from the RBA, as well as hopes of more rate hikes from the Reserve Bank of New Zealand (RBNZ).

The New York Times (NYT) released a piece of news suggesting Ukrainian drones attacked military bases hundreds of miles inside Russia and escalated war fears. The news joins recent hawkish expectations from the Fed and the RBNZ, backed by firmer economics, as well as dovish bias surrounding the RBA to keep the AUD/NZD bears hopeful.

That said, the RBA is expected to announce a 0.25% rate hike and may signal the end of hawkish moves, which becomes more of interest to the market players of late. However, RBA Governor Philip Lowe recently stated that the central bank’s decision to downshift reflects monetary policy lags. The same challenges the AUD/NZD sellers amid recently strong Aussie inflation numbers.

On Monday, Australia’s AiG Performance of Construction Index for November rose to 48.2 versus 43.3 whereas S&P Global Services PMI rose more than 47.2 initial forecasts to 47.6 while the Composite PMI also improved to 48.0 versus 47.7 prior. Further, TD Securities Inflation for November jumped to 5.9% YoY and 1.0% MoM compared to 5.2% and 0.4% respective priors.

Looking forward, the RBA Rate Statement will be more important than the Interest Rate Decision and should be observed for clear directions.

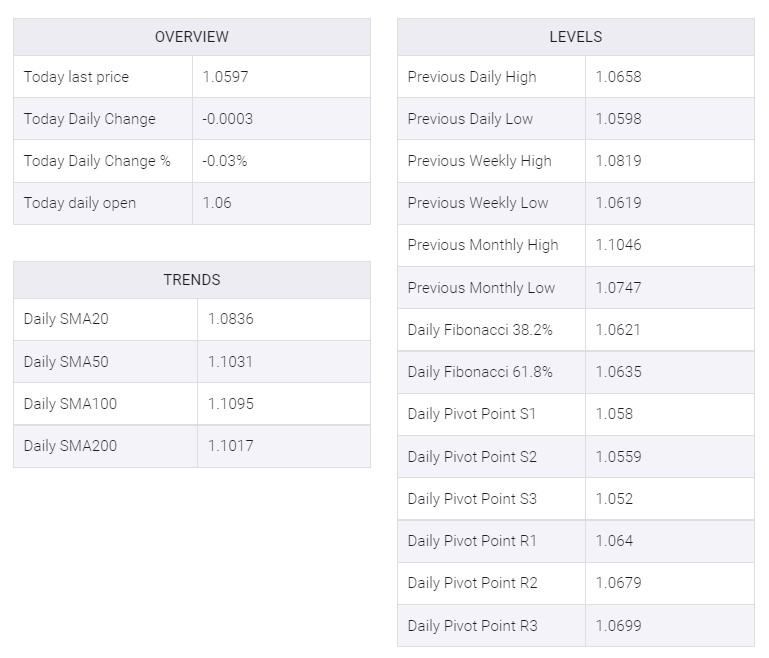

A clear downside break of the 14-month-old horizontal support area surrounding 1.0610-15 directs AUD/NZD bears towards an upward-sloping support line from September 2021, close to 1.0580 at the latest.

ADDITIONAL IMPORTANT LEVELS

No comments:

Post a Comment