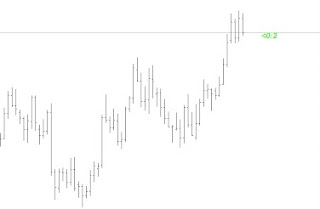

Candlestick charts are one of the three types of charts in technical analysis. Candlestick charts are the best choice! Why?

- Technical analysis has 3 types of price charts, including: Line chart, Bar chart, and candlestick chart.

- Line chart: It is a primitive chart form in technical analysis (used from the early days). The line chart is based on the closing price of the trading session, so it gives too little information about the happenings of the trading session.

- Bar chart: This chart is better than Line chart, because we can know the opening price, closing price, high price, and low price of the trading session. In terms of features, the bar chart is full of features and information for analysis.

- Candlestick chart: This chart was created by the Japanese, so it is also called "Japanese candlestick chart". This is the best type of chart, full of information, intuitive and very easy to understand. It is the most used today, especially forex traders.

- The structure of the candle is illustrated through the image below:

- Through the image of the candle, you can recognize several signals of the market, for example:

+ The upper shadow and the lower shadow are both short: The bullish force or the bearish force is strong (strong force, price moves in one direction)

+ Long upper shadow and short lower shadow: The price signal is going down.

+ Short upper shadow and long lower shadow: Upward signal.

+ The opening price is close to the closing price (doji candle): There is hesitation of both buyers and sellers (equilibrium, neither side dominates)

- Some candlestick patterns you should learn more about: Pinbar pattern, Inside Bar, Hammer, Doji, Morning Star,...

Best regards,

No comments:

Post a Comment