- GBP/USD has dropped after the conclusion of the short-lived pullback to near 1.1976 amid a risk-off mood.

- Hawkish commentary from Fed policymakers is aiming to bring US Treasury yields back to life.

- The UK economy is expected to deliver negative GDP growth for four consecutive quarters.

The GBP/USD pair has witnessed selling pressure around 1.1976 in the Tokyo session. The short-lived recovery in the Cable from the cushion of 1.1940 has been terminated as hawkish commentaries from Federal Reserve (Fed) policymakers have strengthened the risk aversion theme.

The US Dollar Index (DXY) has resumed its upside journey after a corrective move to near 106.60. S&P500 futures have rebounded marginally in the Asian session but the road to reversal is still far. Meanwhile, the 10-year US Treasury yields have recovered to near 3.69%.

The alpha generated by US Treasury bonds has resurfaced as investors believe that deceleration in the interest rate hike doesn’t resemble a pause in further policy tightening. The headline United Stated inflation is at 7.7%, far from the targeted rate of 2%, and required a heap of effort from the Federal Reserve (Fed) policymakers.

Richmond Fed Bank President Thomas Barkin said on Monday that he supports smaller interest-rate hikes ahead as the central bank moves to bring down too-high inflation, as reported by Reuters.

Also, Cleveland Fed Bank President Loretta Mester believes that the Federal Reserve is not near to a pause in a rate hike, as reported by Financial Times. She added that more good inflation reports and more signs of moderation are required before building an action plan of pausing rate hikes.

Going forward, the US Gross Domestic Product (GDP) data will be keenly watched. The preliminary GDP for the third quarter is seen unchanged at 2.6%. As the Fed is dedicated to bringing price stability, a slowdown in the growth rate is highly recommended. A spell of improvement in the growth rates will continue to keep reign into inflation as solid GDP indicates robust demand from individuals, which doesn’t lead to the path of a decline in price growth.

On the Pound front, Economists at Danske Bank have confirmed that the United Kingdom has entered a recession. They expect negative GDP growth for four consecutive quarters and growth not to return until the fourth quarter of CY2023.

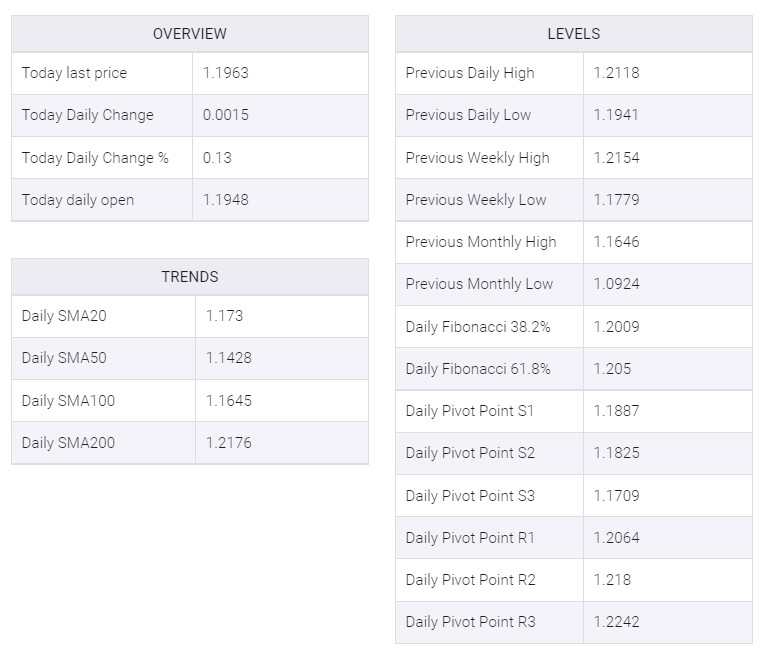

GBP/USD

No comments:

Post a Comment