- AUDUSD takes offers to renew intraday low even after strong Aussie data, amid risk-off mood.

- Australia’s Q3 Wage Price Index beat market consensus and prior readings.

- NATO, G7 members call emergency meeting after an alleged Russian missile attack on Poland.

- Concerns surrounding the US Federal Reserve’s pivot, China’s Covid conditions will also be important to watch.

AUDUSD extends pullback from a two-month high, down 0.30% intraday near 0.6740, even as wage data from Australia came in firmer on Wednesday. That said, the Aussie pair’s latest weakness could be linked to the market’s fresh fears, emanating from Poland.

Australia’s Wage Price Index rose 1.0% QoQ versus 0.9% market forecasts and 0.7% prior readings. The yearly figures also came upbeat while crossing the expectations and previous readings with the 3.1% YoY numbers.

Earlier in the day, Australia’s Westpac Leading Index for October dropped to -0.1% versus -0.05% prior.

It’s worth noting that the Group of Seven Nations (G7) and North Atlantic Treaty Organization (NATO) Ambassadors are up for an emergency meetings after an alleged Russian attack on the Polish border with Ukraine. Even so, Polish President Andrzej Duda told reporters, per Reuters, “Poland has no concrete evidence showing who fired the missile that caused an explosion in a village near the Ukrainian border.” The policymaker also added that it is very likely that they will activate NATO’s Article 4 on Wednesday.

Additionally weighing the AUDUSD prices could be the headlines from the Financial Times (FT) saying, “China’s coronavirus test providers have reported a surge in unpaid fees as cash-strapped local governments struggle to fund a mass testing program that is central to President Xi Jinping’s zero-Covid policy.” The otherwise unimportant news gains major attention amid a surge in the coronavirus numbers from the dragon nation, also the main customer of Australia.

Against this backdrop, the S&P 500 Futures drop 0.40% while the US 10-year Treasury yields remain sluggish near 3.76% at the latest.

Having witnessed no major reaction to the Aussie data, mainly due to the risk-off mood, the AUD/USD pair traders may wait for the US Retail Sales for October, expected 1.0% versus 0.0% prior, for clear directions.

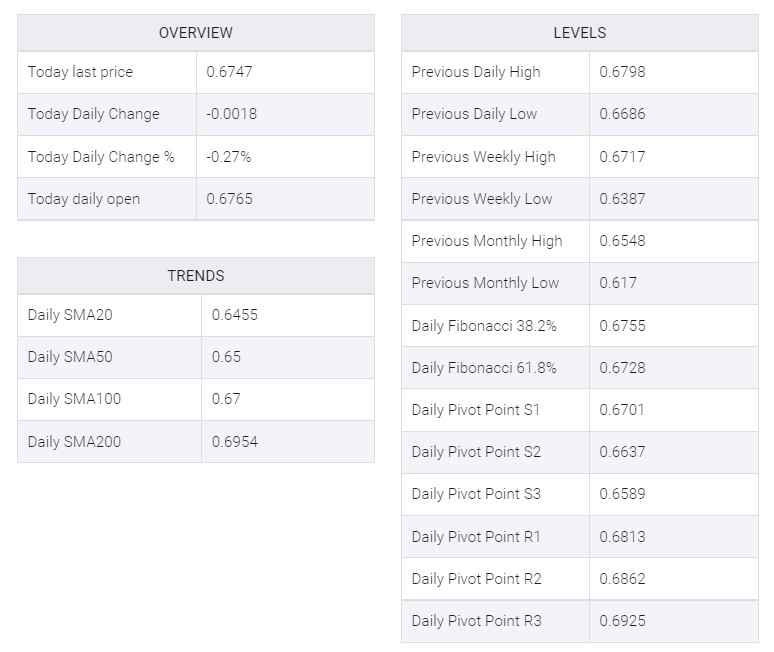

The 100-DMA challenges AUDUSD bears around 0.6700 and hence the pair’s further downside appears limited. Alternatively, September’s high near 0.6920 is the key hurdle to the north.

ADDITIONAL IMPORTANT LEVELS

No comments:

Post a Comment