Ichimoku Kinko Hyo is one of the technical indicators that I have consistently used for more than five years. In today’s article, I want to share the key advantages that make me unwilling to remove it from my charts. I also borrowed the idea of the “4.0 industrial revolution” in the title, with the hope that this article will bring something fresh and valuable to you.

Before going into Ichimoku itself, I need to clarify my personal viewpoint on technical indicators. After years of studying and applying them, I have realized that most indicators are lagging by nature. If a trader applies them strictly by textbook definition, the results will often be disappointing.

Meaning: Tools are not sacred. Only the result matters.

Now let’s move into the main topic. I will not explain the textbook definitions or components of Ichimoku Kinko Hyo, as most traders already know them. One quick look at the standard Ichimoku chart shows all main elements, and that is enough.

Below are the practical advantages I personally get from Ichimoku. Whether you consider these basic or advanced depends entirely on how deeply you understand the system.

Chikou Span – The Green Line

Chikou Span is simply the lagging line of price. To me, it functions like a line chart, and because line charts remove candlestick noise, they make support and resistance zones easier to see at a glance. If you like using it, feel free to leave it on the chart.

As for me, I almost always hide it. I am a Candlestick-focused trader, and Chikou Span is not necessary for my analysis.

Tenkan-Sen – The 9-Period Line

Tenkan-Sen is a 9-period moving average and is useful for detecting early movements when the price interacts with it or begins to slope strongly. Many traders use it for short-term reactions.

However, because I have used Ichimoku long enough, I also hide this line in most cases. I rarely need it.

Kijun-Sen – The Core of Ichimoku

Kijun-Sen, to me, is the heart and soul of Ichimoku. It is also a moving average — calculated over 26 periods — but it reflects market structure far better than Tenkan-Sen. More importantly:

Kijun can be FLAT.

A flat Kijun provides powerful information and trading opportunities. When Kijun becomes flat, it acts as a magnet that pulls price toward it, especially if price has stretched too far in one direction.

Let’s consider a downtrend:

-

Price rallies too deeply upward, moving above Kijun (which is unusual in a strong downtrend)

-

At this moment, Kijun becomes flat

-

The combination creates a high-probability SELL scenario, with price likely to fall back to the flat zone

You can see this in the EUR/USD examples I have shared in other articles — the arrows mark exactly this situation.

From a theoretical perspective, the explanation is simple:

In a downtrend, selling pressure is stronger than buying pressure. If the current price rises above the 26-period average, price is now in an imbalance. The high probability outcome is for price to move back downward.

When Kijun Flat combines with Flat Kumo, the effect is even stronger. If the two flat zones overlap, pay close attention — this often creates high-probability, high-precision trading setups.

Kijun as a Wall Against Trend Reversal

In a downtrend, early retracements often push above Kijun (because the trend is still developing). Later on, as the trend strengthens, price can only retrace back to Kijun before falling again.

Eventually, when the trend weakens, price may rise above Kijun again and test it from below. If the reaction changes character at that time, a trend reversal may be starting.

You can think of Kijun the same way as Kumo: the more times price hits it, the weaker it becomes. Eventually, the “wall” breaks and the trend ends.

In sideways conditions, Kijun becomes the axis around which price oscillates. The Kijun area represents dynamic equilibrium.

Kijun also provides an excellent natural 50% Fibonacci retracement reference. Many times you do not even need to draw Fib levels — just observe where price interacts with Kijun.

Kumo – The Ichimoku Cloud

Kumo has many shapes and personalities:

-

Sometimes thick

-

Sometimes thin

-

Sometimes steep

-

Sometimes flat

-

Sometimes expanding

-

Sometimes changing color

If you use Ichimoku long enough, you will naturally begin to categorize these cloud “postures” into recognizable trading conditions.

In this article, I want to emphasize two main aspects:

-

Flat Kumo

-

Kumo as a trend barrier

Just like Kijun, when Kumo becomes flat, it creates a pull-back force — but it is a “retracement force,” not a continuation force. This means Kumo Flat often signals that price may return to equilibrium after an overextended move.

Whether price then continues the trend or reverses entirely depends on higher timeframe analysis.

This is why I always use Ichimoku together with:

-

Multi-timeframe analysis

-

Volume confirmation

-

Timing techniques

Using Kumo to Understand Trend Strength

There are two simple but powerful principles:

-

The position of price relative to the cloud shows the trend

-

Price above cloud → uptrend

-

Price below cloud → downtrend

-

If price has not yet touched the cloud during a trend, the trend is strong

-

Multiple cloud touches → trend weakening

-

Price hovering inside cloud → trend extremely weak, potential reversal (only confirmed with higher timeframe analysis)

-

Always validate with higher timeframesA signal on one timeframe is meaningful only in relation to the larger market structure. Without multi-timeframe alignment, Ichimoku’s assessment becomes incomplete.

Examples

Yesterday (March 6, 2018), I posted a SELL signal on USD/JPY. On H4, the downtrend was very clear. Price was still located below the cloud, meaning the bearish trend structure was intact.

At the same time, on H1:

-

Price had risen too far upward

-

Kijun was flat

-

Kumo was also flat and overlapping the flat Kijun

-

This created a strong imbalance

Therefore, I sold, with the target set around the flat Kijun area — the natural equilibrium point.

Another example:

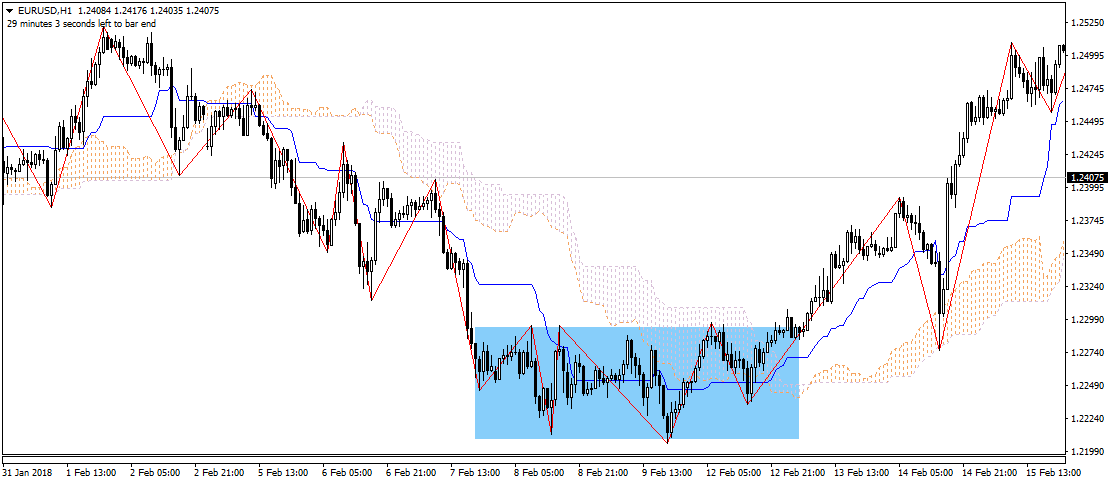

On EUR/USD:

The downtrend on H1 did not end until price drifted sideways below the cloud with multiple touches. That weakening aligned with the fact that:

-

D1 showed a strong uptrend

-

Price had completed its correction

-

H4 showed a sharp drop into an existing Flat Kumo zone

When multiple timeframes align, Ichimoku becomes extremely powerful.

Final Thoughts

These are a few personal insights gained from years of trading with Ichimoku Kinko Hyo. If you truly enjoy the indicator and feel that it fits your trading personality, keep studying it and exploring deeply. One day, you may become a true master of Ichimoku.

No comments:

Post a Comment